The GBP/USD currency pair continued its decline on Friday despite the lack of significant macroeconomic or fundamental events. The reasons for the British pound's drop mirrored those of the euro. As we noted earlier, conclusions regarding the FOMC meeting should not be drawn immediately after the event but at least 24 hours later. What did we see on Thursday evening? There is almost no market activity—just a minor drop in the dollar and a lack of significant interest. However, on Friday, the dollar gained 70 pips. Even though the pound has been largely stagnant in recent weeks, this does not alter the broader outlook. The main thing is that the market reacted with dollar buying immediately after the Federal Reserve's meeting. The pound sterling has struggled to correct significantly. We consider these two factors very important.

Over the next five trading days, the UK and the U.S. will release several important reports. Therefore, all attention is focused on these countries. Let's start with the UK. On Tuesday, reports on the UK's unemployment rate, jobless claims, and wage growth. While these are noteworthy, they will hardly affect the British currency globally. On Friday, the UK will release September's preliminary Q3 GDP estimate and industrial production data. These reports may trigger market reactions but are unlikely to overshadow inflation reports. Inflation figures remain the primary driver of Bank of England policy decisions. Thus, UK data may influence the pound intraday but not much beyond that.

In the U.S., the spotlight will be on the Consumer Price Index (CPI) for October, which remains crucial for the U.S. central bank. Fed Chair Jerome Powell has reiterated the importance of incoming data in shaping monetary policy decisions. If inflation rises as forecasted, the likelihood of a December rate cut will approach zero. This would be excellent news for the U.S. dollar, reinforcing that the market has priced in an overly dovish Fed policy.

In addition to inflation, we should note the producer price index, jobless claims, Powell's speech, retail sales, and industrial production. While these reports may spark intraday reactions, Powell's speech following the CPI release could provide critical insights into the Fed's December plans. If inflation rises, the dollar is well-positioned for further gains.

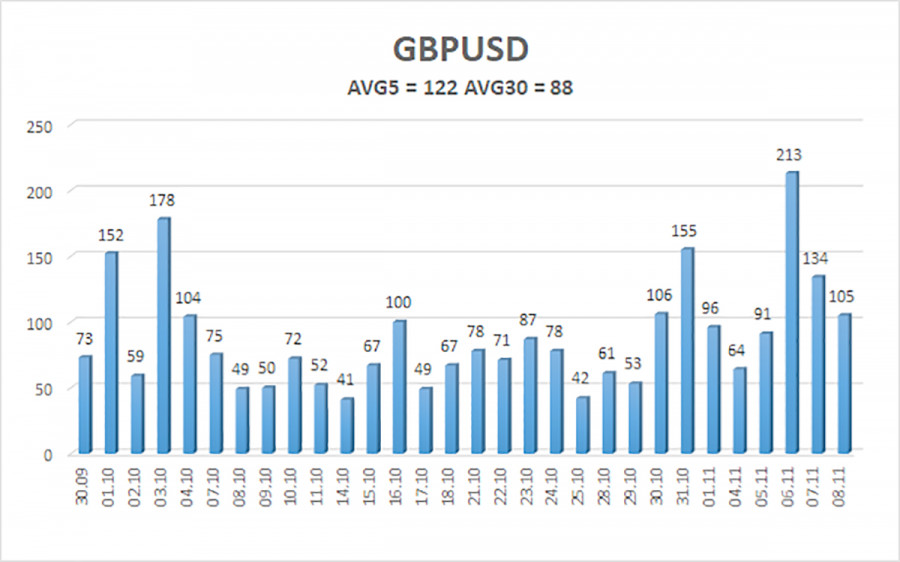

The average volatility of the GBP/USD pair over the last five trading days is 122 pips, which is "high" for the pair. On Monday, November 11, we expect movement inside the range bounded by the levels of 1.2794 and 1.3038. The higher linear regression channel is trending downward, indicating a bearish outlook. The CCI indicator has formed a bullish divergence, but the correction appears to have already played out, leaving the pair in a flat range.

Nearest Support Levels:

S1: 1.2909

S2: 1.2878

S3: 1.2848

Nearest Resistance Levels:

R1: 1.2939

R2: 1.2970

R3: 1.3000

Trading Recommendations:

The GBP/USD pair maintains its bearish trend. We still do not recommend long positions, as the market has already priced in potential bullish factors for the pound multiple times. Long positions could target 1.3000 and 1.3031 for those trading pure technical setups, but only if the price moves above the moving average. Short positions remain more relevant, targeting 1.2848 and 1.2817 as long as the price stays below the moving average.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.