The EUR/USD currency pair experienced another notable decline on Friday. As previously mentioned, it is unwise to conclude market reactions or the results of the FOMC meeting immediately after the event. So, what did we observe and learn? The Federal Reserve cut the key interest rate by 0.25% (as expected). Fed Chair Jerome Powell adopted a somewhat hawkish tone, suggesting that the Fed might decide not to lower rates in December. While this is not a definitive signal for a pause, Powell urged markets to refrain from hasty conclusions.

As previously noted, ample reasons remain for the U.S. dollar to strengthen. What should we expect this week? What should we pay attention to? There will be several interesting events in the European Union, but there will be very few significant macroeconomic reports and speeches. On Tuesday, Germany will publish the inflation report for October, but it will be only the second estimate. However, the market has already digested the initial, more important estimate, so significant differences are unlikely. ZEW Economic Sentiment Index is also due but is not considered a critical indicator. The Eurozone's Q3 GDP report will be released on Thursday, but this is the second (and least significant) estimate. An industrial production report will also be published, but it is unlikely to shift market sentiment or deter traders from buying dollars. Germany and the Eurozone's economic calendars are essentially empty on Monday, Wednesday, and Friday.

Thus, no crucial events will be in the European Union this week. Therefore, we can immediately conclude that the market will again focus on American events, among which we can highlight the inflation report at a minimum. What are the prospects for the EUR/USD pair? It is incorrect to assume that a lack of news will result in stagnant prices. Currently, the market is heavily inclined toward buying dollars. With this sentiment, the market doesn't need strong macroeconomic or fundamental support to continue this trend. The overarching influence of the Fed's rate policy can guide movements without a local macroeconomic backdrop. Furthermore, U.S. data typically holds greater importance than European data.

We anticipate the EUR/USD pair will remain under pressure this week, trending downward. The pair trades below the moving average, suggesting a bearish bias. While a collapse is unlikely, the U.S. inflation report could trigger significant moves if its results are unexpected.

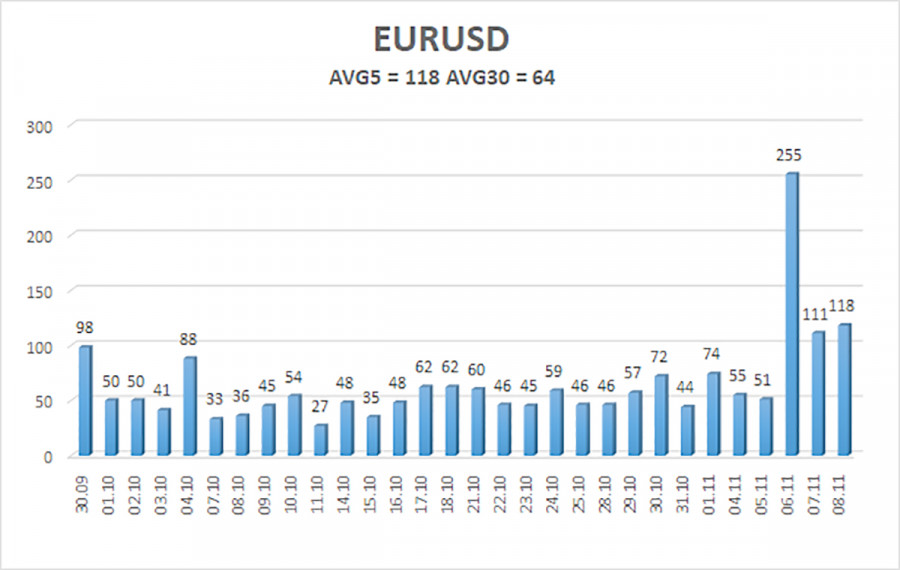

The average volatility of the euro/dollar currency pair over the last five trading days as of November 10 is 118 pips and is characterized as "high." We expect the pair to move between the levels of 1.0608 and 1.0837 on Monday. The higher linear regression channel is directed downward; the global downtrend is still intact. The CCI indicator entered oversold territory, hinting at a potential reversal. However, this may already be complete.

Nearest Support Levels:

S1: 1.0681

S2: 1.0620

Nearest Resistance Levels:

R1: 1.0742

R2: 1.0803

R3: 1.0864

Trading Recommendations:

The EUR/USD pair has resumed its downward movement. Over recent weeks, we have consistently expected declines in the euro in the medium term, supporting a bearish trend. The market has likely already priced in all, or nearly all, future Fed rate cuts. If so, there is little reason left for the dollar to weaken. Short positions remain viable with targets at 1.0620 and 1.0608, provided the price stays below the moving average. For pure technical traders, long positions are possible if the price rises above the moving average, with targets at 1.0901 and 1.0925. However, we do not currently recommend long positions.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.