¬алютна€ пара GBP/USD все также продолжала падение. ¬еро€тно, к фунту стерлингов эта фраза менее применима, чем к евровалюте, но по факту именно так дела и обсто€т. Ѕуквально вчера мы говорили о том, что фунт стерлингов поджимаетс€ к своим двум последним локальным минимумам и, веро€тнее всего, преодолеет их. »менно так и случилось во вторник. “аким образом, британска€ валюта хоть и продолжает демонстрировать просто потр€сающую резистентность по отношению к доллару, все же ей тоже сложно сопротивл€тьс€ объективным фактам.

ј факты эти продолжают говорить только о падении британской валюты. Ќекоторые эксперты считают, что фунт стерлингов обойдетс€ без сильного падени€ в ближайшее врем€, так как Ѕанк јнглии не спешит снижать ключевую ставку, опаса€сь роста инфл€ции. ћы отчасти согласны с этим предположением, но хотим напомнить, что доллар —Ўј начал падать за два года до того, как ‘–— впервые понизила ключевую ставку. “аким образом, рынок вполне может начинать заранее избавл€тьс€ от британской валюты, не дожида€сь того момента, когда Ѕанк јнглии проснетс€.

ѕомимо этого, состо€ние британской экономики продолжает вызывать огромное количество вопросов. ¬ 2024 году завелось так, что многие эксперты называли мизерный рост ¬¬ѕ Ђвосстановлениемї и Ђвполне оптимистичным результатомї, хот€ по факту британска€ экономика не растет уже два года. ј вчера стало известно, что уровень безработицы подскочил до 4,3%, а средние заработные платы выросли на 4,3%. ¬ обоих случа€х прогнозы были превышены. онечно, второй отчет Ц это, скорее, хороша€ новость дл€ британской валюты. Ѕолее высокие темпы роста зарплат означают, что британцы будут тратить больше, а инфл€ци€ имеет более высокие шансы на новое ускорение. Ёто действительно так. ќднако мы хотим напомнить, что Ѕанк јнглии в любом случае будет продолжать снижение ставок, а, так как глава государства Ц не ƒональд “рамп, то роста инфл€ции из-за внешней политики опасатьс€ не стоит.

ћы считаем, что фунт стерлингов будет продолжать падение, но делать это может действительно медленнее, чем евровалюта. ¬ принципе, это уже сейчас видно по показател€м волатильности. “аким образом, уже сейчас фунт падает, но падает медленнее евровалюты. ќднако, на наш взгл€д, речи о возобновлении двухгодичного восход€щего тренда не может быть. Ќа этой неделе должно состо€тьс€ еще одно выступление Ёндрю Ѕейли, а рынок будет пристально следить за его Ђголубинымиї намеками. ≈сли прозвучат фразы, касающиес€ замедлени€ инфл€ции или же продолжени€ снижени€ ставок, фунт стерлингов может вновь устремитьс€ вниз. ≈сли ƒжером ѕауэлл на этой неделе вновь намекнет на возможную паузу в декабре, это вновь поможет американской валюте. ≈сли инфл€ци€ в —Ўј вырастет до 2,6% в годовом выражении или выше, это также создаст новое давление на пару GBP/USD. оррекции вверх возможны, но в среднесрочной перспективе мы продолжаем смотреть только на ёг.

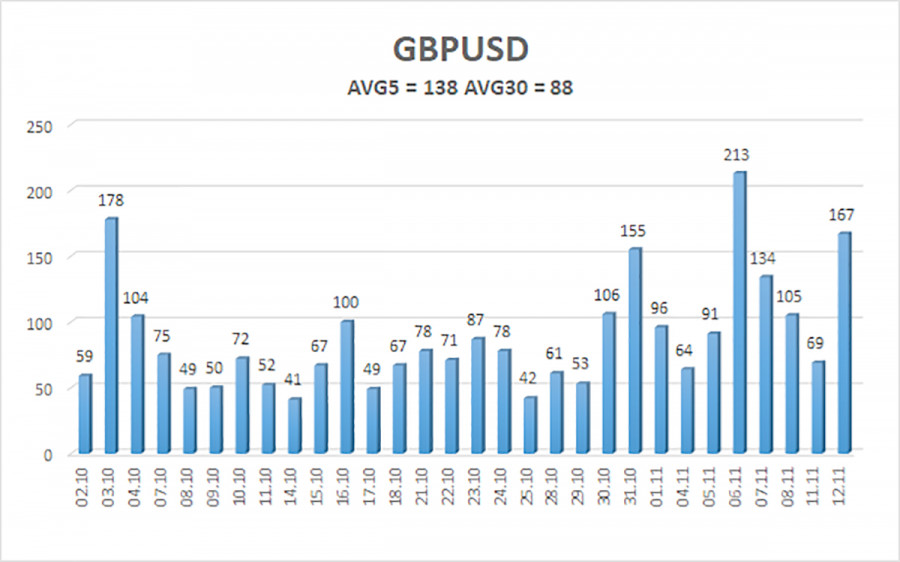

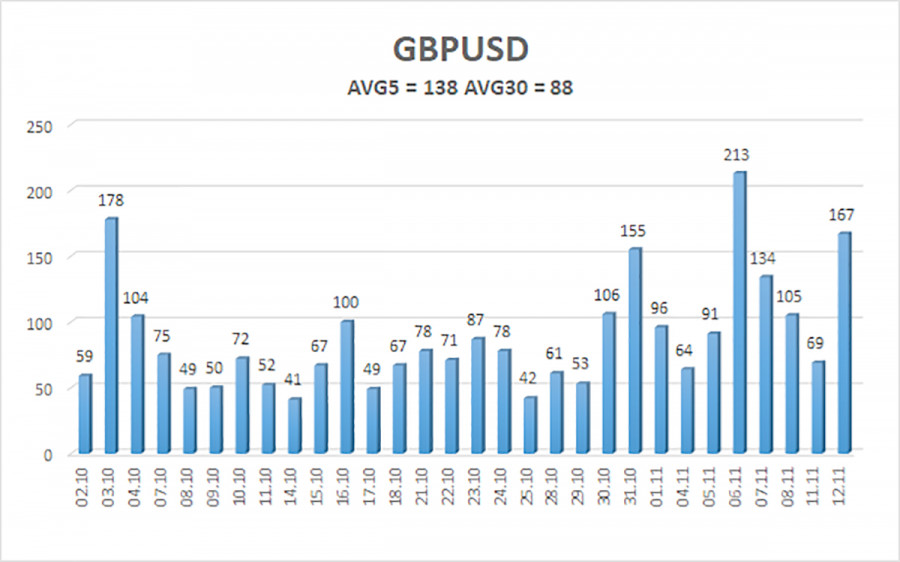

—редн€€ волатильность пары GBP/USD за последние 5 торговых дней составл€ет 138 пунктов. ƒл€ пары фунт/доллар это значение €вл€етс€ высоким. ¬ среду, 13 но€бр€, таким образом, мы ожидаем движени€ внутри диапазона, ограниченного уровн€ми 1,2592 и 1,2868. —тарший канал линейной регрессии развернулс€ вниз, что сигнализирует о нисход€щей тенденции. »ндикатор CCI сформировал Ђбычьюї дивергенцию, но откат уже произошел, а цена вновь валитс€ вниз.

Ѕлижайшие уровни поддержки:

S1 Ц 1,2695;

S2 Ц 1,2634;

S3 Ц 1,2573.

Ѕлижайшие уровни сопротивлени€:

R1 Ц 1,2756;

R2 Ц 1,2817;

R3 Ц 1,2878.

—оветуем ознакомитьс€ с другими стать€ми автора:

ќбзор пары EUR/USD. 13 но€бр€. ќбвал евровалюты продолжаетс€.

“орговые рекомендации и разбор сделок по GBP/USD на 13 но€бр€.

“орговые рекомендации и разбор сделок по GBP/USD на 13 но€бр€.

“орговые рекомендации:

¬алютна€ пара GBP/USD сохран€ет нисход€щую тенденцию. ƒлинные позиции мы по-прежнему не рассматриваем, так как считаем, что все факторы роста британской валюты были отработаны рынком уже несколько раз. ≈сли вы торгуете на Ђголой техникеї, лонги возможны с цел€ми 1,3000 и 1,3062 при расположении цены выше скольз€щей средней линии. ороткие позиции гораздо более актуальны в данное врем€ с цел€ми 1,2634 и 1,2592 до тех пор, пока цена располагаетс€ ниже мувинга.

ѕо€снени€ к иллюстраци€м:

аналы линейной регрессии помогают определить текущий тренд. ≈сли оба направлены в одну сторону, значит тренд сейчас сильный;

—кольз€ща€ средн€€ лини€ (настройки 20,0, smoothed) определ€ет краткосрочную тенденцию и направление, в котором сейчас следует вести торговлю;

”ровни ћюрре€ Ц целевые уровни дл€ движений и коррекций;

”ровни волатильности (красные линии) Ц веро€тный ценовой канал, в котором пара проведет ближайшие сутки, исход€ из текущих показателей волатильности;

»ндикатор CCI Ц его заход в область перепроданности (ниже -250) или в область перекупленности (выше +250) означает, что близитс€ разворот тренда в противоположную сторону.